06 Nov 2025

06 Nov 2025

Many businesses are still manually entering their invoice data into accounting or ERP system, this can be very problematic in the long run, when businesses need to scale, they have to encounter many issues such as: typos, missed invoices, approval delays, and hours of repetitive work that pull finance team away from high-value tasks.

According to one benchmark, the average cost of processing an invoice manually sits around US$15, which is considered quite expensive, especially for SMEs.

The solution? Connecting your invoice software to your ERP. This guide provides an explanation of what invoice-ERP integration is, why it is important to your business and how successful it is implemented.

Table of Contents

What is Invoice Application Integration?

Invoice application integration links your ERP system to your invoice application to enable you to automatically capture a lot of the invoice processing workflow rather than manually entering invoice data.

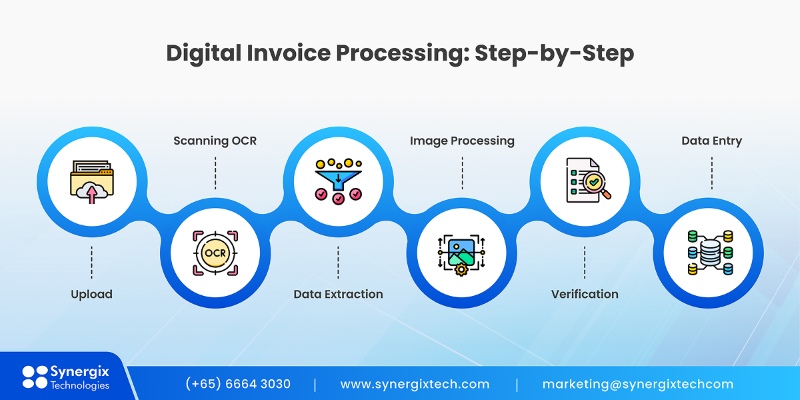

The process of integrating invoices starts when an invoice is received in the system with the help of the email, a supplier portal, or a scanned document. The software will automatically pull out such important information as the name of the vendor, invoice number, and line items, total amounts and due dates. Accuracy of these details is then checked with purchase orders and receipts in the ERP system. With a corresponding information, the invoice is directed to the relevant approver according to set business-related regulations. Upon approval, it is immediately transferred over to accounting module of the ERP to make payments. This simplified process helps to save on manual data entry, minimises errors and shortens the general invoice processing process.

Why SMEs Should Integrate Invoice Processing with ERP System

Time and Cost Savings

Research shows manual invoice processing can cost between US$12 to US$35 per invoice, depending on complexity and volume.

For example, processing roughly 500 invoices per month can really make a difference in the annual cost saving plan of a small business.

Improved Accuracy and Compliance

Manual data entry error-rates are high. One source reports nearly 39% of invoices contain errors.

Integrated systems can automatically check vendor data, match PO/GRN records and route exceptions for review,leading to fewer mistakes and better audit trails.

Better Cash Flow Management

When invoice data is siloed or delayed, you lose visibility into what you owe and when. Incorporating it enables you to see the real-time picture of payables, approvals on their way, and when to make payments, and minimise the timing of payments and prevent late payments and early-payment discount.

Scalability for Growth

Manual processes don’t scale. It is common among many SMEs that the higher the amount of invoices, the more employees they require. By automating and integrating ERP, you will be able to work with more invoices using the same staff, freeing up space to expand, enter new markets, carry out more transactions with multiple currencies and more.

Read more: Everything about Invoice Billing Software for SMEs in 2025.

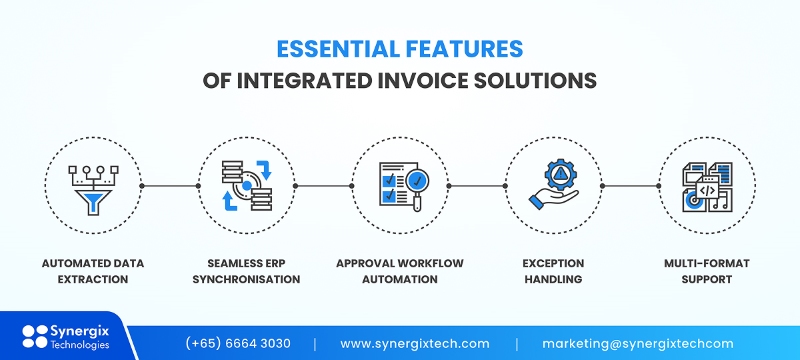

Essential Features of Integrated Invoice Solutions

Not all invoice-ERP integrations are equal. With an SME, the following are the features that you should focus on:

- Automated data extraction: Use OCR to get data out of PDF, email or scanned invoices, no typing required.

- ERP synchronisation: Send invoice data into your ERP (AP/GL) modules in real time.

- Automated approval: Forward invoices to the appropriate individual depending on the rules like amount, department or cost center.

- Exception handling: Clear routing for non-PO invoices, mismatches, vendor claim issues, with full audit trail.

- Multi-format: PDF, scanned images, XML/EDI and supplier portals.

Implementation: A Practical Approach

Planning Phase

Trace your invoice process up to now, starting with invoice receipt, all the way to payment: where does it hang? What causes errors? Who are the bottleneck approvers? Establish specific KPIs (e.g., decrease the processing time by 50 percent, decrease the cost per invoice by 60 percent). Ensure that your ERP is compatible with invoice-automation.

- Preparing: Start with less complex types of invoices such as utilities, office supplies… and then move on to PO-matched invoices.

- Training: Configure workflows, business rules, test with real invoices whilst the old process is running concurrently. Train exceptions, train dashboards and status viewing.

- Monitoring & Optimising: Conduct weekly metrics tracking in the first month. After getting data and feedback, make adjustments on thresholds, vendor formats, and workflows.

Challenges & Solutions

- Connection problemswith existing systems

Majority of SMEs have more than one system which is ERP, procurement, accounting and inventory. The issues arise when the systems are unable to share data without difficulties, e.g.:

- Vendor names are formatted differently

- Currency or tax formats don’t match

- Invoice data doesn’t sync with the ERP

How to fix: Choose one that already has the capability to be integrated with popular ERPs (SAP, Oracle, Microsoft Dynamics or Synergix ERP). Test it on a small scale using few invoices or a department and then implement it in the entire company.

- Inaccurate or inconsistent data

Clean data is a requirement in automation.Duplication or outdated vendor records, item codes or GL accounts will cause errors in the system including invoice mismatching or the allocation of costs.

How to fix: Pre-integration procedures should be to clean up your vendor master list and standardise names. This ensures mistakes are avoided and less manual corrections are made later on.

- Low user adoption

Automation has several individuals – procurement, finance, department managers.In case the process is perceived to be complex, users will shun the system and revert to the manual emails or spreadsheets.

How to fix: Keep workflows simple at the beginning. The first process to automate is the one that has a direct impact on another process (e.g. purchase requests to purchase orders), train people clearly, and offer internal process owners to direct others.

Selecting an Invoice Integration Solution for Your SME

Begin with compatibility in ERP. The solution must be integrated with your ERP without any heavy customisation. Enquire of vendors whether they have worked with your specific version of ERP and how they keep up with updates.

Next, consider scalability. The more your business will grow, the more your invoice volume will grow. An efficient system must be able to accommodate volume and multiple entities, and also the various currencies, without involving additional staff.

Ease of use is also crucial. Therefore, the finance team should be in a position to monitor invoice status, workflows, and exception resolution on its own. An nicely designed interface and good routing logic is superior to an unlimited set of configuration.

Customer success and assistance are more important to SMEs compared to large companies. Find suppliers with guided onboarding, training, and regional support, rather than knowledge base alone.

On the other hand, the overall cost of ownership, including the implementation, support, and training should also be taken into consideration, not only the software subscription.

Read more: Complete Guide to Understanding E-Invoice Singapore in 2025

When discussing with vendors, ask them these questions:

- Has your solution integrated with our ERP before?

- How long does a typical SME implementation take?

- How do you handle updates without disrupting operations?

Why Synergix Technologies

At Synergix Technologies, our ERP solutions are based on SMEs in our case study of Asian businesses, in which we realise that IT resources are limited, and there is stricter budget and faster ROI requirements. Our ERP application also provides invoice automation directly. The technical complexity is taken care of by us; and you run your business.

We have assisted hundreds of SMEs to leave their manual invoice processing systems behind and go to automated, efficient workflows, and save time, mistakes and expenses.

The process of invoices manually is not sustainable by the emerging SMEs. When you combine your invoice evasion with your ERP, you become more efficient, more accurate and have greater financial control, and your staff are now left with time to concentrate on strategic work rather than on keeping the books.

Conclusion

A combination of your invoice application and ERP system will eliminate redundant manual processes and enhance accuracy in all forms of the invoice generation process. Invoices are automated and automatically matched with purchase orders and approved and posted into the ERP instead of keying the data into various systems. This will provide your finance department with faster processing, fewer mistakes and instant cash flow and spending.

Key takeaways:

- Invoice capture automation is associated with less manual data entry and human error.

- Integration guarantees all the information of invoices is saved within a single system – your ERP.

- The successful adoption is the result of a structured approach (clean data, phased rollout, training).

- SMEs acquire improved control of costs and expedited cycles of payments.

Automation will have an immediate impact in case your team continues to use emails, spreadsheets, or various systems to process invoices.

Contact us to schedule a free demo. Our consultant will take you on a tour of the invoice integration process and demonstrate how it can be integrated into your existing workflow.