12 Feb 2026

12 Feb 2026

The cash flow is always a source of pressure for most of the SMEs, even when sales are on the rise. Long customer credit terms slow down the collection and lower the cash visibility. The invoicing and follow-ups, which are manual, further slow the process, and small finance teams can hardly keep up. Such loopholes complicate the process of forecasting and augment financial risk.

Accounts receivable payment software offers a practical way to address these issues. With the receivables data centralisation and automated routinised tasks, the finance teams can have better insight as to what is outstanding and when. This blog explains what the software does, the benefits it delivers, how SMEs can evaluate and implement it, and the real outcomes businesses can expect.

Table of Contents

- 1 What Is Accounts Receivable Payment Software?

- 2 Typical Accounts Receivable Issues of an SME

- 3 Essential Features That Enhance Cash Flow

- 4 How Accounts Receivable Payment Software Strengthens Cash Flow

- 5 Integration Matters: AR as Part of a Connected Finance System

- 6 Selecting the Right Accounts Receivable Payment Software

- 7 Key Takeaways

- 8 Conclusion and Next Steps

What Is Accounts Receivable Payment Software?

Accounts receivable payment software is a system designed to manage invoicing, collections, receipts, and reconciliation in one place. It also substitutes the disjointed tracking approaches with a methodical and uniform procedure. There are still numerous SMEs dependent on spreadsheets and manual updates to them and the possibility of errors. Single-purpose billing systems enhance the speed of invoicing but usually do not go beyond the areas of collections and cash application.

The AR solution is integrated, and billing, reminders, matching receipts, and reporting are interconnected. It offers an end-to-end visibility of invoice to cash when it is coupled with the ERP software, accounting, and bank systems. This integration helps in scalable finance operations without the need to employ more people.

Learn more: What Is Enterprise Resource Planning?

Typical Accounts Receivable Issues of an SME

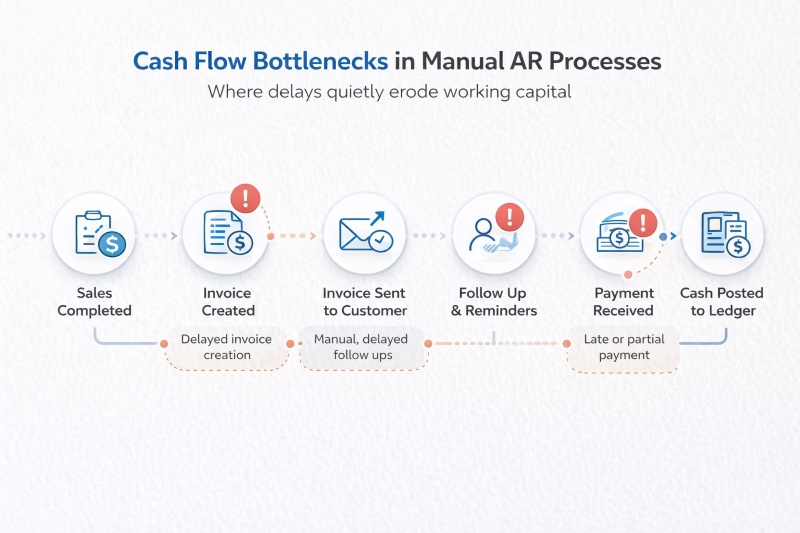

Not all SMEs have a strained cash flow as a result of low demand; a good number of them have a strained cash flow owing to the friction in the receivables processes. Delays in payments are still a problem, and balances are not always clear between the teams. The process of invoicing is often done manually and, therefore, delays issuance and exposes the company to missing follow-ups. There can be ageing reports, but they are either outdated or hard to prioritise.

Receipt matching and reconciliation also take a lot of time, particularly when the payments are received without clear references. Prediction of cash inflows is not reliable due to incomplete or delayed data. These problems multiply rapidly with small finance departments handling increasing amounts of money. Accounts receivable payment software addresses these pain points by simplifying workflows and improving visibility, rather than adding operational complexity.

Essential Features That Enhance Cash Flow

The right accounts receivable payment software focuses on speed, accuracy, and control. Key features include:

- Automated invoicing and delivery: Sales or delivery is followed by instant generation and subsequent sending of invoices, decreasing the time taken in billing and missed billing periods.

- Receivables ageing and visibility: Customer and invoice real-time ageing assists in financing teams prioritising the most critical collections to be paid first.

- Automated reminders and dunning: Reminder schedules can be configured to ensure regular and professional follow-ups are made without human intervention.

- Payment tracking and reconciliation: Invoices are matched against receipts, thus reducing the errors in posting and the time required in reconciliation.

- Credit control and limits: Transparency of credit exposure will be useful in avoiding excessive extension and will facilitate healthier customer relations.

Collectively, these capabilities will result in better predictable inflows of cash and a decrease in manual intervention.

Learn more: How to Avoid a Cash Flow Crisis with ERP System

How Accounts Receivable Payment Software Strengthens Cash Flow

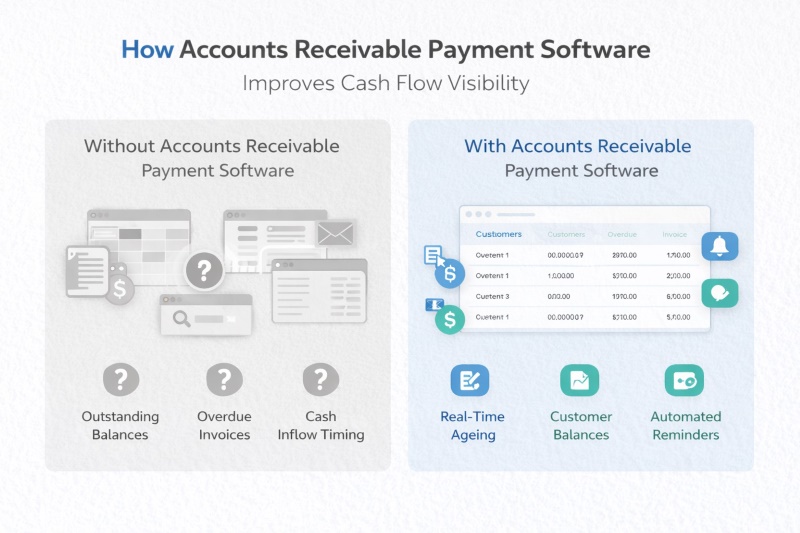

Accounts receivable payment software delivers measurable improvements that directly support healthier cash flow. Through automation of invoicing, reminders and tracking, businesses reduce Days Sales Outstanding because invoices are issued in good time and reminders pursued. Centralised records minimise disputes, as finance departments no longer have to trawl through emails and spreadsheets to locate invoices, delivery and payment histories.

Cash inflows will be more predictable with the real-time visibility of outstanding balances and ageing. The finance leaders become confident in the short-term forecast and working capital planning. Automation also helps in lessening the operational load on small finance teams, which enables them to handle increased volumes of transactions in the same period without increasing the number of employees.

The customer experience is enhanced by precise payments and prompt communication. The customers are also presented with clear invoices, professional instead of ad-hoc reminders, and problems are solved more quickly. In markets like Singapore, where SMEs are likely to experience long payment cycles, such gains assist businesses to maintain a liquid state and minimise short term funding. Well-implemented accounts receivable payment software strengthens control while keeping processes simple and scalable.

Learn more: Accounts Payable Software Solutions Using ERP System in 2026

Integration Matters: AR as Part of a Connected Finance System

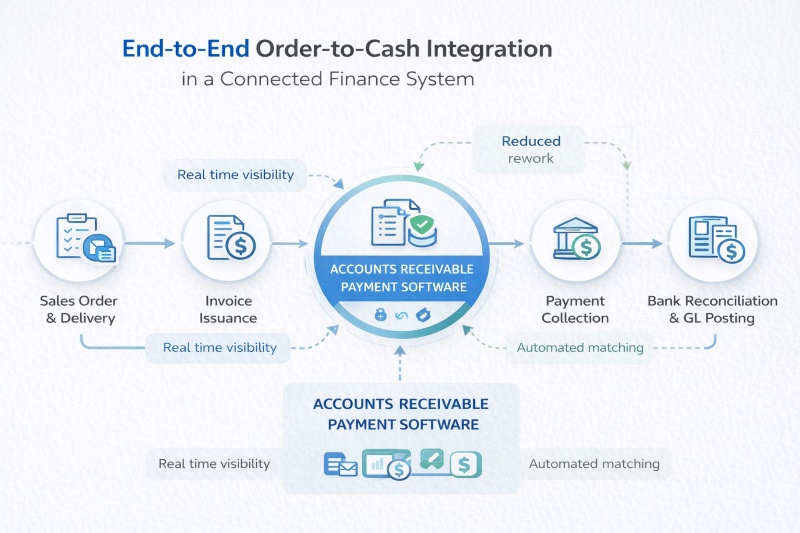

Accounts receivable should never work in a vacuum. Delays and errors are inevitable when AR is not linked to sales, inventory, and accounting. AR management requires a strong connection with sales orders and deliveries; hence, invoices show what has really been delivered. Closely linked with the general ledger, posts are correct and financial reports are reliable.

Linkage to banking systems and payment gateways also helps the order-to-cash cycle speed up orders so that receipts can be matched in a short time, and less effort is required to reconcile. ERP systems like Synergix ERP are based on AR systems and incorporate all these elements within one environment.

The outcome is end to end traceability, sales order all the way up to delivery, invoice and payment. Finance and operations operate on the same data, double entry is minimised, and month end operations are facilitated. Integrated AR enhances greater control, better reporting and quicken realisation of cash within the business.

Selecting the Right Accounts Receivable Payment Software

Choosing the right accounts receivable payment software requires a practical, SME focused evaluation. Begin by ensuring that the system is matched to your volume of transactions and your customers without the need for excessive complexity. Evaluate automation complexity and make certain that there is an even balance between efficiency and the right level of manual controls on exceptions.

Local compliance is also a must. The software must not have workarounds in support of GST reporting and regulatory requirements. Compliance involves adhering to accounting standards (GAAP/IFRS) for revenue recognition, maintaining detailed documentation for audits, and following fair debt collection practices.

It should also be able to integrate, especially with your current ERP or accounting system, to prevent the existence of duplicate data and reconciliation problems.

Check on the quality of reporting, particularly on the ageing of receivables and the level of customer visibility. The implications of these insights are on the effectiveness of collection and cash planning. Lastly, consider vendor support, local presence, and scalability for business expansion. Proper knowledge of the total cost of ownership and anticipated ROI makes the solution provide a long term value other than short term convenience.

Learn more: Invoice Application Integration with ERP Software for SMEs

Key Takeaways

- When receivables are visible and controlled, cash flow will be improved

- Automation minimises delays, improving customer relationships

- Integration across finance and sales is critical

- A sound selection process can yield measurable results

Conclusion and Next Steps

Improvement of sustainable cash flow begins with better control over receivables. Finance teams are able to react promptly and with certainty when processes are transparent, and the information is on display. Accounts receivable payment software provides the discipline, speed, and clarity SMEs need to manage growth without increasing risk.

SMEs are expected to review current AR workflows and identify loopholes that lead to delays or uncertainty. With that, the focused application of the right technology can be used. AR solutions that are based on ERP like Synergix ERP provide a scalable basis linking receivables and the sales and finance. The next step to consider is to learn more about receivables readiness review or to schedule a system demo to see how the improvement will be translated into actual cash flow impact.